- Fayette County Public Schools

- Homepage

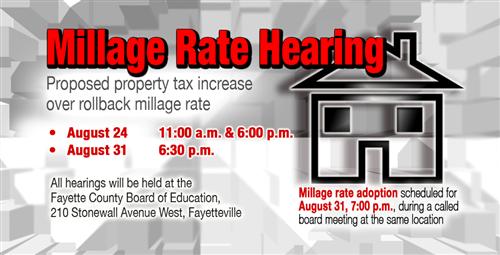

Fayette County Board of Education Announcing Proposed Property Tax Increase Over Rollback Millage Rate

CORRECTED COPY 8/19/26:

Each year, the board of tax assessors is required to review the assessed value for property tax purposes of taxable property in the county. When prices on properties that have recently sold in the county indicate there has been an increase in the fair market value of any specific property, the board of tax assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment.

When the total digest of taxable property is prepared, Georgia law requires that a rollback millage rate must be computed that will produce the same total revenue on the current year’s digest that last year’s millage rate would have produced had no reassessments occurred.

The budget adopted by the Fayette County Board of Education requires a millage rate higher than the rollback millage rate; therefore, Georgia law requires three public hearings be held to allow the public an opportunity to express their opinions on the proposed increase.

All concerned citizens are invited to the public hearings on this tax increase to be held at the Fayette County Board of Education building located at 210 Stonewall Avenue, Fayetteville, Georgia on August 24, 2016 at 11:00 AM and 6:00 PM*, and August 31, 2016 at 6:30 PM.

The millage adoption is scheduled to occur August 31, 2016 at 7:00 PM during a called board meeting at the location listed above.

Melinda Berry-Dreisbach

770.460.3535, x.122

berrydreisbach.melinda@mail.fcboe.org